The Electric Last Mile Solutions Headquarters and Vans

The Electric Last Mile Solutions Headquarters and Vans

The last few years but namely two years 2020 through 2022 saw some of the most interesting corporate financing and obscure business vehicle the give rise to the Special Purpose Acquisition Company typically referred to as SPAC’s.

With the meteoric rise of the share price and market capitalization of Tesla, many risk takers have tried to emulate the financial performance by launching their own electric vehicle companies.

An engineer decided it was a brilliant move to start a company selling knock down kits which are essentially IKEA build your own furniture of automobiles. The vans were compiled of a Chinese package, to be assembled in the “Old General Motors” owned manufacturing plant in Mishawaka, Indiana that built the Hummer H2 and H3. That plant was later sold to yet another stillborn Electric Vehicle maker Seres Automotive (originally founded as SF Motors, maybe a story for another day) after they spent $20 million in plant upgrades. Seres Automotive sold the plant in 2021 to ELMS.

The management team at Forum Merger III decided they could make some money but doing a reverse merger with ELMS and taking the company public. The investment slide deck even purports to have “sufficient capital to execute business plan”.

ELMS investment slide deck 2020

Electric Last Mile Headquarters

Electric Last Mile Headquarters June 2022

The ELMS headquarters was located Troy, Michigan. Incidentally it was also located in the prior North American Headquarters for Manhindra which later moved to a new location in Auburn Hills, Michigan and later closed its Troy office.

Without further ado we present to you the dead on arrival Electric Last Mile Electric Vehicle delivery Vans.

The ELMS Vans

Electric Last Mile Headquarters vans

Electric Last Mile Headquarters vans.

A stillborn EV company and its vans

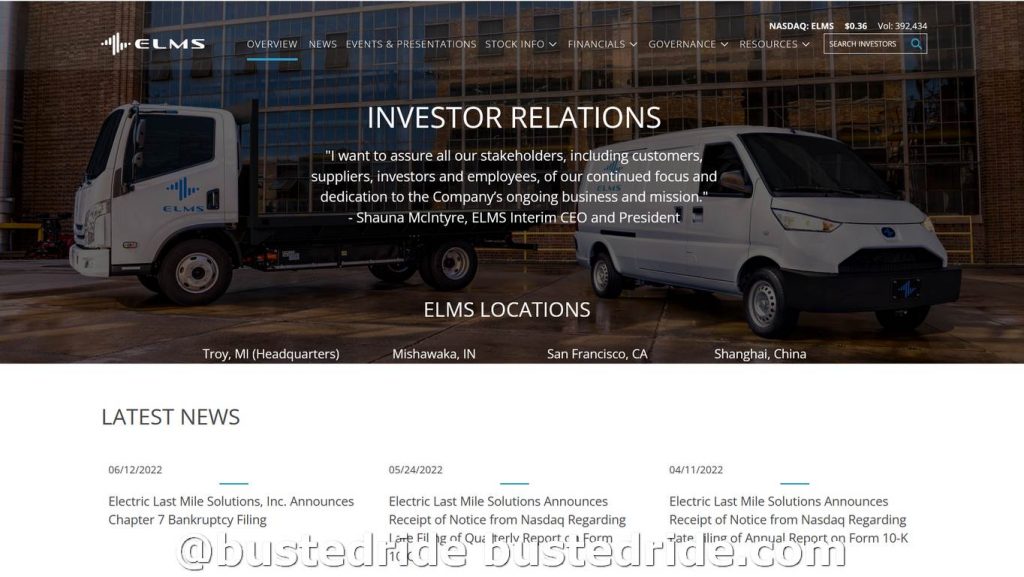

Taking few by surprise ELMS became the first SPAC era electric vehicle company to not only file bankruptcy for restructure, but full on Chapter 7, liquidation. The company did so on a Sunday evening before stock markets are open.

TROY, Mich., June 12, 2022 /PRNewswire/ — Electric Last Mile Solutions, Inc. (NASDAQ: ELMS) (“ELMS” or “the Company”), a pure-play commercial electric vehicle (“EV”) company that has been focused on redefining productivity for the last mile, today announced the Company plans to file for Chapter 7 bankruptcy.

In February 2022, following the resignations of Jim Taylor, the Company’s former Chief Executive Officer, and Jason Luo, the Company’s founder and former Executive Chairman, the Company appointed Board member Shauna McIntyre as interim CEO and President, in part because of her considerable automotive experience.

The ELMS Board and the new leadership team under Ms. McIntyre launched a comprehensive review of the company’s products and commercialization plans, instilled a culture of safety and focused the workforce on producing quality vehicles. This process included assessing the Company’s planned product offerings, production plans, and certification processes, including the feasibility of meeting previously announced targets.

Based on the findings of the same Board-initiated investigation that led to the resignations of Mr. Taylor and Mr. Luo, ELMS was forced to withdraw financial guidance and declare the Company’s past financial statements unreliable. The compound effect of these events, along with a pending SEC investigation initiated this year, made it extremely challenging to secure a new auditor and attract additional funding.

Yet the Company continued to work aggressively on raising new sources of capital, while working closely with advisors to assess and improve its liquidity position. Ultimately, the Board determined, following a comprehensive review with the assistance of the Company’s outside advisors, and upon the recommendation of the Company’s management, that it is in the best interest of the Company and the Company’s stockholders, stakeholders, creditors, and other interested parties to file for Chapter 7 relief.

“I’m very disappointed by this outcome because our ELMS team demonstrated incredible determination to get our electric vans ready to meet the critical need for clean, connected vehicles that reduce carbon emissions from ground transportation,” said Ms. McIntyre. “Unfortunately, there were too many obstacles for us to overcome in the short amount of time available to us. I could not be prouder of what our team has been able to accomplish under very challenging circumstances. This is a viable and essential technology, and I am confident that many of our talented employees will play a future role in this energy transition effort.”

“For the past several months, the ELMS board and the new ELMS leadership team have worked nonstop to address legacy financial, governance and operational matters at the Company, and enormous progress was made, including towards vehicle certification” said Brian Krzanich, ELMS Board Chair and former CEO of Intel. “Therefore, it’s extremely frustrating that we must take this route, but it was the only responsible next step for our shareholders, partners, creditors, and employees.”

About Electric Last Mile Solutions, Inc.

Electric Last Mile Solutions, Inc. (Nasdaq: ELMS) has been focused on defining a new era in which commercial vehicles run clean as connected and customized solutions that make businesses more efficient and profitable. ELMS’ first vehicle, the Urban Delivery, was anticipated to be the first Class 1 commercial electric vehicle in the U.S. market. For more information, please visit www.electriclastmile.com.

Chapter 7 liquidations often mean all assets will be split up to the highest bidders to recover the funds to pay creditors. In these scenarios it looks very unlikely that these odd little delivery vans will ever see the light of day beyond these photographs in the United States. Given that they named themselves a product category and not really a name, that seems to have little to no value, and we’d expect no competitors to bid on these branding assets.

Investors in for a wild ride

The story is still playing out for investors. Who in normal stock market times would expect to see their stock holdings in ELMS to drift slowly ever day to the valuation of $0.00. The pandemic era hits different with Hertz famously rallying hundreds of percent over days as investors believed it to be much more than zero.

June 16 a handful of days after the Chapter 7 liquidation declaration the stock rallied, well for no good reason.

June 16 2022 ELMS stock valuation

As the ELMS stock eventually falls into zero compliance with exchange it is listed on, expect to see it vanish and reappear with a Q on the end. So eventually you’ll find it as ELMSQ.

So remember the screenshots will be saved here to internet history and future penny stock investors.

June 2022 ELMS website screenshot